YU Chunxue

Here is Snowy (喻春雪). I am pursuing my doctoral degree in Computational Social Science at The Chinese University of Hong Kong, Shenzhen. Happy to engage in academic conversations! My email is 224030231@link.cuhk.edu.cn.

A small fish 🐟

Programming: Python, Stata, MATLAB, C++(poor) | Tools: Stata, LaTeX

Education

-

M.S., Quantitative in Finance SMU (08/2023 - 07/2024) -

M.A., Applied Economics DUFE (09/2021 - 01/2024) -

B.E., Environmental Engineering and Accoutnting JLU (09/2017 - 06/2021)

Work Experience

Research Assistant @ Singapore Management University (02/2024 - 08/2024)

- Organize annual reports of Chinese listed companies and analyze personal resumes of management team members, compiling them into a database.

- Conduct in-depth analysis of executive backgrounds, focusing on their experiences in environmental work, government positions, and employment in public institutions.

Research Assistant @ Dongbei University of Finance and Economics (01/2022 - 01/2023)

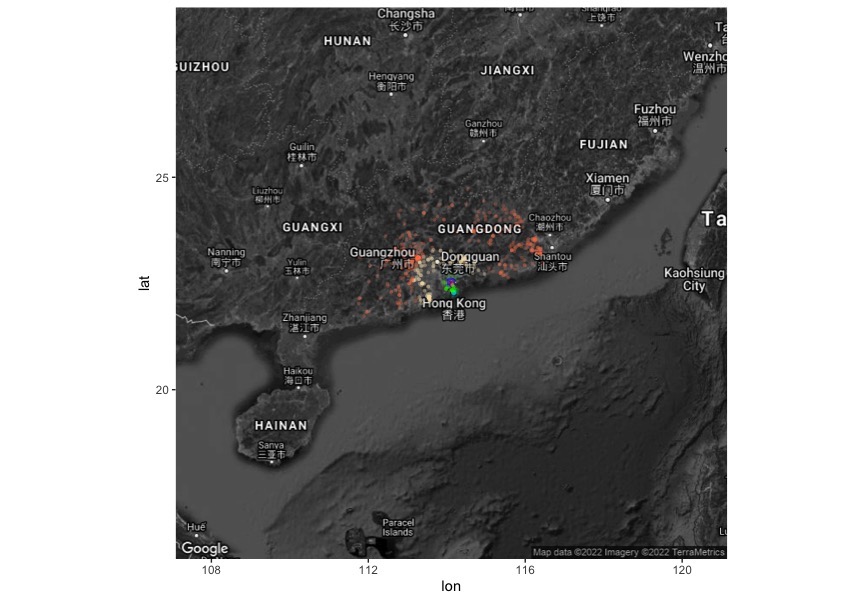

- Leveraged R to extract data from Gaode maps, collecting geographic information relevant to specified keywords, acquiring longitude and latitude data, and organizing geographical datasets.

- Utilize Stata to organize microdata from household surveys such as CHFS. Analyze the dynamic financial situation of Chinese households. Study household data and decision-making in financial markets around the world, with primary focus on China, EU, and US.

Projects

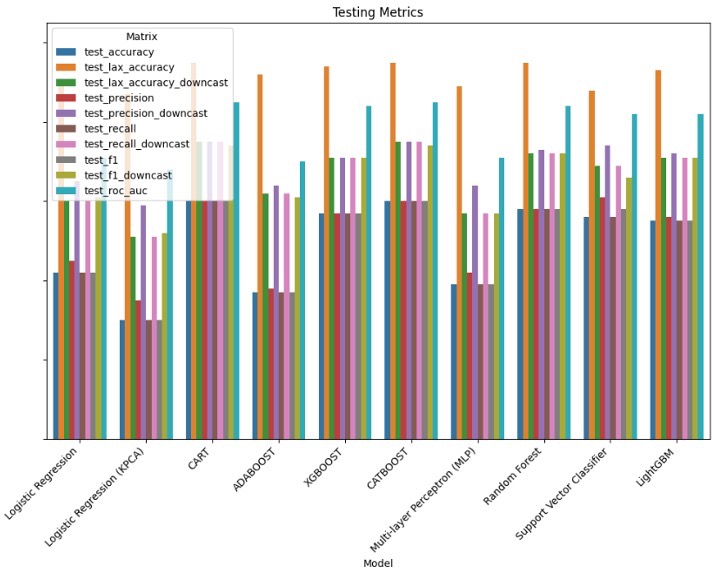

Machine Learning Application - Developed a robust predictive model using a range of machine learning techniques to estimate the credit risk ratings of companies.

Developed machine learning models to predict corporate credit ratings using financial ratios from 2029 US firms with Python. The project compared various models, including CATBOOST, XGBOOST, and Random Forest, which outperformed traditional methods with a 91% accuracy. A novel “Notch Distance” metric was introduced to measure deviations between predicted and actual ratings, enhancing model evaluation. Additionally, extensive hyperparameter tuning using GridSearchCV, RandomizedSearchCV, and Bayesian Optimization significantly improved model performance and efficiency. The approach offers a scalable solution for timely and accurate credit rating predictions.

C++ for Financial Engineering - Developed a C++-based trade pricing engine to evaluate a portfolio of trades using two days of market data.

The project implemented multi-threading to enhance performance during the calculation of portfolio metrics, including Present Value (PV), DV01, and Vega. Design patterns were employed for trade creation, ensuring scalability and code maintainability. A PnL calculation was performed by comparing the PV between the two dates, and the portfolio’s risk was analyzed. Additionally, a strategy was designed to either square off the portfolio’s risk or maximize PnL within pre-defined DV01 and Vega limits, providing a robust framework for portfolio risk management and optimization.

Publications

Not quite there yet, but going full beast mode!